Mind the Employee Compliance Readiness Gap

Greater scrutiny from regulators, a new hybrid work environment, and other rapidly changing variables have increased the complexity of doing business; raising the risk of reputational damage and financial sanctions on both firms and individuals from employee compliance issues. The spectre of significant consequences means that companies should review what they can do to protect themselves and their employees from falling through the gap.

The SEC issued a record-breaking $6.4 billion in enforcement actions in 2022, which includes $4 billion in penalties, surpassing the total enforcement figures for both 2021 and 2020.

Often, the failure of a financial services firm or its employees to comply is not deliberate – the sheer complexity of monitoring compliance in a regulatory environment that is never static can be overwhelming, so non-compliance may be inevitable. The expectation for faster turnaround times, the need to monitor growing trading volumes for potential misconduct, and ensuring that all employees are up-to-date on their training and competency (T&C) and certification requirements, is stretching many compliance teams to breaking point.

And that’s not all. Compliance officers have a difficult balancing act that requires a constant rebalancing of conflicting priorities and risks. This creates a ‘compliance paradox’.

The Compliance Paradox: A Balancing Act

On the one hand, compliance officers must deliver a frictionless user experience that – with a light touch – collects and monitors data for non-compliance, without interrupting business operations. On the other, they must also take a high-touch approach to ensuring employee engagement with compliance processes.

If this fine balance tips towards taking a rigid approach to compliance, it may be perceived as slowing business processes down. Conversely, if the compliance function opts for a more laissez-faire approach, this could increase the firm’s exposure to a range of risks. A happy medium is therefore needed to resolve the tension between these competing priorities.

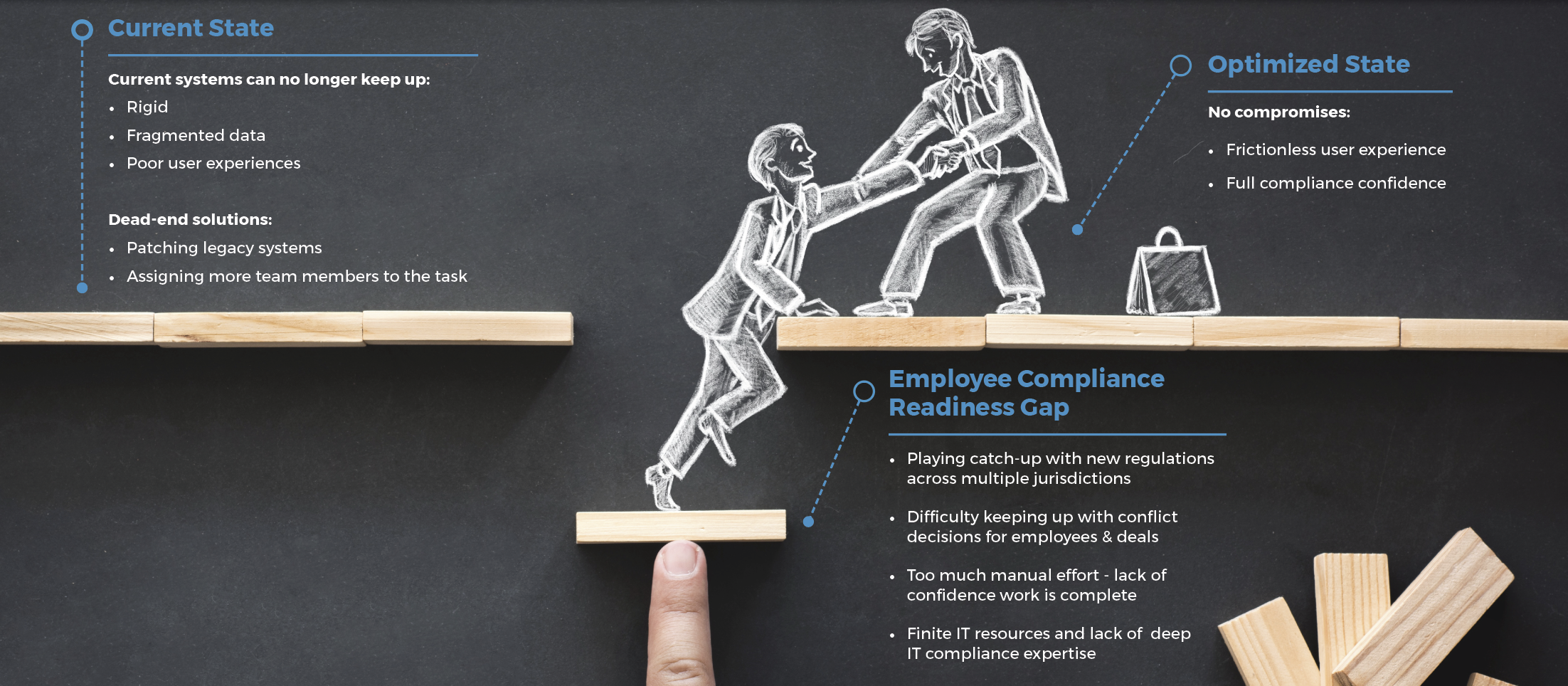

The rigidity of current systems and their inability to integrate disparate data sources means they’re unable to solve the compliance paradox. Difficult to navigate for both compliance officers and employees, they provide a suboptimal user experience and create the ‘Employee Compliance Readiness Gap’:

So, how can compliance teams bridge the Employee Compliance Readiness Gap, and reach an optimized state where frictionless user experience and full compliance confidence are achieved?

Bridging The Employee Compliance Readiness Gap

To overcome this paradox, compliance officers must be proactive and act now to resolve the conflicting demands of compliance and user experience. There’s no need for trade-offs in compliance but getting there requires a fundamental shift in a firm’s mindset.

Misconceptions about the role of compliance are rife, with compliance officers viewed as policing the business rather than partnering with it; lacking knowledge or understanding of the business instead of being considered a trusted advisor; being anti- rather than pro-business; or risk-averse rather than risk managers.

But this has more to do with the rigid, uncompromising system that compliance teams must answer to than the role of compliance itself. In reality, compliance officers are collaborative team members, and company culture and processes should reflect this. Compliance must evolve past a rules-based, reactive approach, where action is only taken after an incident occurs. Employees shouldn’t feel as if compliance is watching them over the shoulder, waiting for the first slip-up. Instead, compliance officers should be independent risk managers to help employees avoid compliance issues in the first place.

This isn’t possible with rigid legacy systems, which depend on inefficient, error-prone, repetitive manual processes and fragmented data, and offer a poor user experience. Endless system patches and additional headcount won’t change this. The solution? A platform that centralizes data and allows for intelligent, proactive decisions based on a holistic view. Automating these processes will strengthen the firm’s overall business. It relieves compliance of the paradox and ensures the firm is ‘future-ready’, with a flexible solution that can evolve as the regulatory landscape continues to shift – and become increasingly complex.

To learn more about bridging the Employee Compliance Readiness Gap, fostering a culture of compliance in your organization, and navigating the shifting financial regulatory compliance landscape, download and read our new e-book: The Compliance Officer’s Ultimate Guide to Employee Compliance.

The Compliance Officer’s Guide To Employee Compliance