2022 Compliance Benchmark Survey: Summary Findings

Survey Demographics

Total Firms Responded

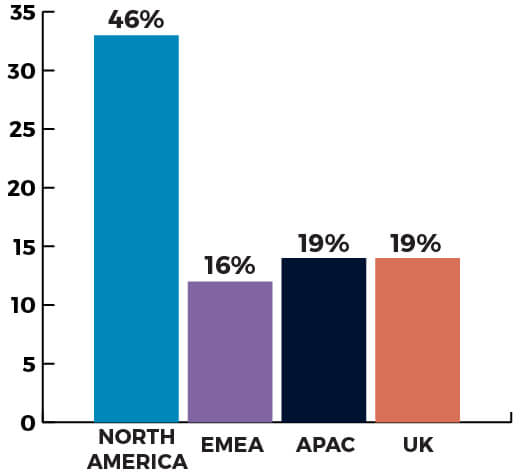

By Region

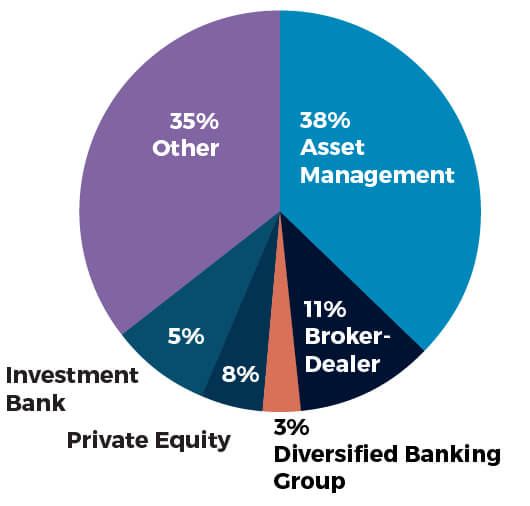

By Segment

Key Findings

20 firms indicated that they anticipate significant changes to their compliance programs in 2022.

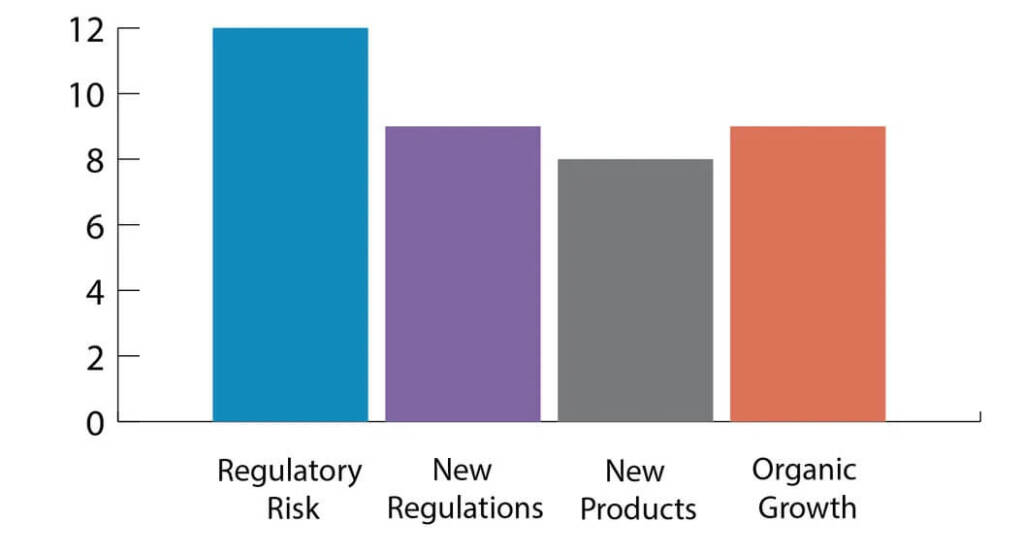

15 of those 20 named the following key factors as shaping their current and future-state compliance priorities:

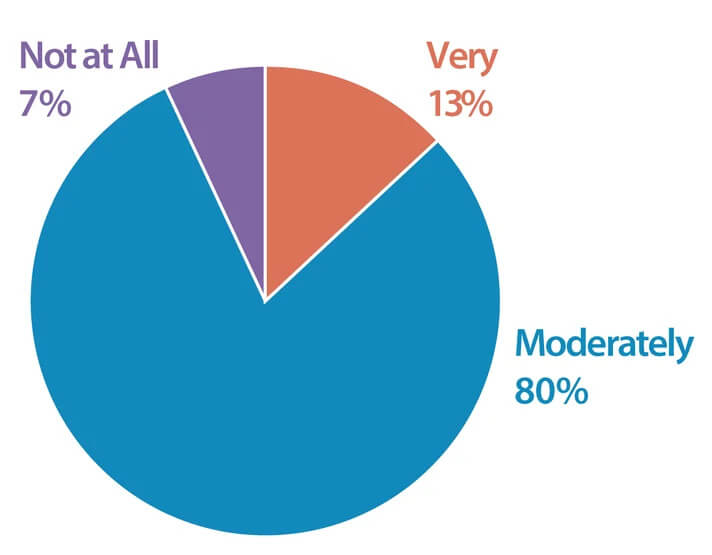

And 15 reported the following levels of concern, when asked about increased compliance officer liability for failed compliance programs:

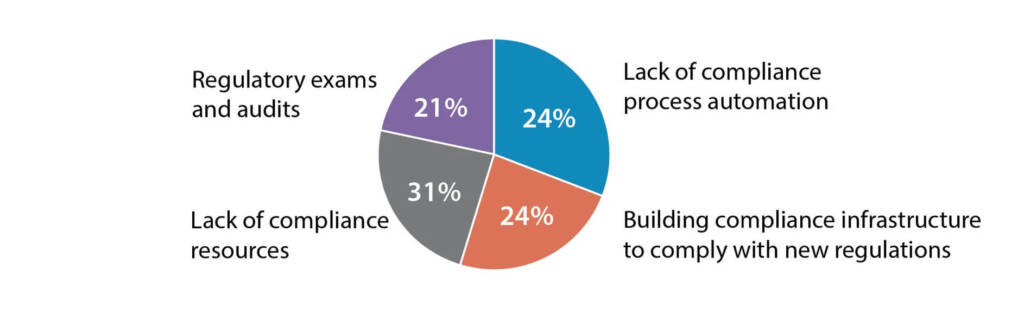

15 cited the following key challenges facing their compliance programs:

Key Learnings & Takeaways

Compliance Officers Must Be More Impactful

Compliance officers spend too much time plowing through data and not enough time assessing risk. By automating non-core responsibilities, firms can give compliance teams more bandwidth to reduce operational, regulatory, and reputational risks.

93% of respondents expressed real concern about compliance officer liability. Reducing such risks through automation can go a long way toward quelling such increasingly common fears and retaining top compliance talent in a tight labor market.

Transparency Is Critical For An Effective Program

Automated platforms give compliance teams the ability to connect data, identify patterns, synthesize information into actionable insights and then easily share that knowledge.

They also allow compliance officers to quickly provide a clear audit trail, which gives regulators more confidence in firm compliance programs. It’s an easy way to evidence compliance.

Compliance Teams Should Be Business Partners

Compliance often finds itself in a losing tradeoff. The business side wants frictionless experiences for customers and employees, while compliance wants confidence in firm processes and policies. That no longer has to be the case, however.

The right automated tools—sophisticated, integrated compliance software platforms—can create better and more obvious alignment between compliance and business objectives: clearly highlighting the business value of the office of the CCO.