Head of Business Development

As Head of Business Development, Steve Brown is responsible for helping drive growth at Star, with a focus on go-to-market planning, data and vendor partnerships, channel sales, new markets, and mergers and acquisitions. Steve joined Star in April 2021, and brings with him 25 years of experience advising financial firms on regulatory compliance. Prior to joining Star, Steve was Director of Broker-Dealer Client Services at Compliance Risk Concepts LLC, a senior director at PwC, and Head of Fixed Income and Capital Markets Compliance at U.S. Bancorp Investments, Inc. Steve began his career at Wachovia, where he was Head of Global Investment Banking Compliance and Control Group, and is considered a pioneer in the control room space—having established the bank’s first formal control room function.

Posts By Author

A Cautionary Tale For Broker-Dealers

FINRA Charges Firm for Supervisory Failures In October, ViewTrade Securities, a broker-dealer, found itself facing regulatory action by FINRA, worth $40,000 in fines, for…

What A New Administration Taking Office in January Could Mean For Regulatory Compliance

Can The Past Inform The Future? With a new administration on the horizon, businesses are bracing for significant changes that could reshape the regulatory…

Shadow Trading Part Deux: SEC Doubles Down on Shadow Trading Theory

The Securities and Exchange Commission (SEC) has made significant strides in its enforcement efforts against insider trading, particularly in the realm of «shadow trading.

Using Data to Monitor Employee Conduct in the Wake of Bonus Cap Increases

As Bonus Caps Increase, So Could Risk Barclays recently became the first major British bank to significantly raise the bonus caps for its senior…

The Past, Present & Future of Political Donations

How the SEC’s ‘Look Back’ Provision Can Affect Employee Compliance Recently, the US Securities and Exchange Commission (SEC) charged Obra Capital Management, LLC with…

SEC Cracks Down on CLO Manager’s Insider Trading Controls

The Securities and Exchange Commission (SEC) recently took action against a registered investment advisor, Sound Point Capital Management, for failing to have proper safeguards…

Understanding the Evolving Role of Compliance Officers & the Liability Risks

CCOs play a critical role in developing strong systems of controls to prevent violations of federal securities laws.

Answering the Needs of the Global Compliance Market

2016 to 2024: A Decade of Regulatory Transformation The world of regulatory compliance is one of constant evolution, driven not only by the ever-changing…

The Trades Are Coming from Inside the Company

Navigating Insider Trading Through the Power of Compliance Technology In the complex world of financial markets, maintaining compliance with insider trading regulations is crucial…

The Weak Link in Surveillance: Validating Models for Effective Detection

This FCA Market Watch is a wake-up call for firms! Firms must build and validate their surveillance models to ensure they function in the correct manner to surface the desired risk.

Navigating FCA’s Consumer Duty Requirements as the Deadline Approaches

Putting The Consumer First As the Financial Conduct Authority (FCA) continues to move toward the implementation of Consumer Duty, on July 31, 2024, financial…

Everything You Need To Know About Employees & Political Donations

As July 4th approaches, so does the intensifying presidential campaign season. It's impossible to escape the flood of fundraising efforts on every device you own. Campaign fundraising in America has reached a fever pitch.

The Importance of Monitoring in Employee Trading Compliance

On April 12, 2024, the financial industry was reminded of the critical importance of strong compliance monitoring when FINRA announced that Barclays Capital Inc. had been censured and fined $700,000.

Understanding FINRA Rule 3210: Essentials for Financial Professionals

Transparency is a fundamental aspect of the financial services industry, essential for building trust and demonstrating accountability.

Remembering Ivan Boesky

Why is it important to remember a person who was convicted of insider trading? So, we can learn from his mistakes. That while some may think “greed is good” it doesn’t mean that insider trading is right.

Renewed Protections for Whistleblowers Change the Game

Does your company reward whistleblowers? Changing legislation reinforces the importance of whistleblower protections.

Voting Leave Notices Are Essential For Upholding Employee Rights

U.S. employers are required to post voting leave notices in their workplace or make them available to remote employees. Find notices for CA, NY, and DC.

How to Save Time Updating Corporate Policies

Smaller HR teams are swamped. Here’s how to save time when updating corporate policies to reflect changing legislation and cultural expectations.

Effective Policy Communication: How to Inform and Educate Employees on Policy Changes

Communicating policy updates is just as important as writing them. Here’s how to ensure everyone is on the same page when updating policies.

SEC Charges Investment Bank and Former ECM Syndicate Banker with “Bought Deal” Fraud

In 2024, the SEC charges Investment Bank for violations preventing the misuse of material, nonpublic information. Find out what happened and how you can prevent it.

Shadow Trading Confirmed!!! Are You Ready???

Shadow trading is here to stay. Star expert, Steve Brown, discusses the recent SEC v. Panuwat case and what that means for your firms' compliance program.

How to Defend Your Company Against a Discrimination or Harassment Lawsuit

Protect your company’s reputation from wayward employees by ensuring your compliance policies are up to scratch.

The Challenges of an Election Year: Monitoring Political Contributions in 2024

Navigating the intricacies of political contributions in the 2024 election cycle poses a challenge for compliance teams trying to mitigate risks.

Going Public in 2024? Don’t Forget Your SOX Whistleblowing Obligation

In the US, all companies planning an initial public offering (IPO) and those with securities outstanding must comply with the whistleblowing requirements of the…

Three Key Trends identified from Star’s Third Annual Crypto & Compliance Market Survey

The popularity of crypto assets among the public has skyrocketed in recent years, as people become more familiar with what they are and how…

FINRA Regulatory Obligations and Related Considerations 2024

FINRA released their 2024 FINRA Annual Regulatory Oversight Report on January 9th.

SEC Charges Investment Adviser for Policies and Procedures Failures

Late last year, (December 26, 2023), the Securities and Exchange Commission (“SEC”) settled charges against OEP Capital Advisors, L.

Where Policy Stops and Enforcement Begins

The Dalai Lama’s timeless advice, «Learn and obey the rules very well so you will know how to break them properly,” has been widely…

Political Contributions, Gifts and Entertainment: How to Take a Proactive Stance Against Bribery and Corruption

When it comes to the monitoring of employee conflicts relating to gifts and entertainment (G&E), and political contributions, it can be challenging for compliance…

SEC vs Virtu: Why Firms Need to Maintain Robust Information Barriers

In September this year, the Securities and Exchange Commission (SEC) filed a civil lawsuit against Virtu Financial, one of the world’s largest electronic trading…

SEC Prohibits Conflicts of Interest in Certain Securitizations

The SEC is adopting Securities Act Rule 192 (part of Section 621 of the Dodd-Frank Act) to prohibit a “Securitization Participant” (e.g.

EU Whistleblowing Decree 2023: How Can You Prepare to Protect Your Employees and Your Reputation?

Since the 2019 EU Whistleblowing Directive came into effect, European authorities have continued to expand legislation to further protect and encourage whistleblowers to come…

Are Bots People Too?

Written by ChatGPT… Edited by humans

3 Ways to Avoid EEOC Retaliation Charges

Each year, the EEOC releases updated charge statistics and the charges that top the list tend to reflect what the nation has collectively gone…

Looking to Streamline Your Policy Development Process?

Having a successful policy management program requires a variety of key elements but there’s one that cannot be understated.

Part 2 | Retiring the Swivel Chair: Making MNPI Easier to Monitor for Private Equity

In the second of two blogs regarding the “swivel chair” Compliance professionals experience when monitoring access to material, nonpublic information (“MNPI”) –– we reference…

5 Areas of Focus For Enhancing Your Company’s Whistleblower Hotline Program

Establishing a whistleblower hotline is an essential part of a company’s structure, however, to ensure both you and your employees get the most benefit…

Retiring the Swivel Chair: Making MNPI Easier to Monitor for Asset Management Firms

Monitoring access to material, nonpublic information (“MNPI”) is too often managed in a ‘swivel chair’ –– Compliance professionals referencing multiple applications, emails, excel sheets,…

Has Title IX Fulfilled Its Promise of Equality?

When Title IX was signed into law on June 23rd, 1972 by President Nixon the promise of equality and change to undo the longsuffering…

Political Contributions – Emails, Texting, and Phone Calls…Oh My!

US presidential campaigning is alive and well, coming to you on any and all devices you own.

Two Departments, One Incident & Policy Management Solution

Human Resources and Compliance departments often struggle to communicate with other departments that are failing to coordinate their data intake and policy management.

ECOI, GRC, IRM, ESG… NOT JUST ALPHABET SOUP

For years, we’ve all paid respect to the disciplines defined by GRC – Governance Risk and Compliance.

Staying Up To Date With FINRA’s 2023 Report For Financial Crimes And Outside Business Crypto Activities

Every year, FINRA releases a report on its Examination and Risk Monitoring Program to help firms strengthen their compliance processes by providing insights into…

How Can Whistleblowing or Incident Reporting Help Improve Employee Compliance?

It goes without saying: fraud, corruption and misconduct have no place in any organization.

Financial Instability and The Shroud of Uncertainty Over Employee Compliance

The recent failures of two US banks along with the rescue of a large Swiss bank and ongoing volatility in the financial sector is…

Casting Further Light on Shadow Trading

When a biopharmaceutical industry executive reportedly learned in 2016 that a rival planned to buy the company he worked for, he is alleged to…

Financial Regulatory Compliance: What to Know For 2023 – Part 1

As we head into 2023, Steve Brown, Managing Director at StarCompliance, assesses the state of financial services compliance and provides an overview of the…

The SEC & DOJ Have Corporate Compliance Zeroed. Are You Ready?

It’s no secret the federal government has been pursuing an aggressive regulatory enforcement agenda of late, but what does it mean for compliance officers trying to keep…

Four Key Findings From Star’s 2022 Crypto & Compliance Survey

For our second annual Crypto & Compliance Survey, we surveyed the marketplace to find out how firms are currently approaching employee crypto-trading compliance and…

5 Top Takeaways From Our California Crypto Compliance Seminar

Are cryptoassets currencies or securities? Who’s going to be regulated and who isn’t? How should firms prepare for whatever’s coming down the regulatory pike?…

Regulatory Alert: SEC Nearly Doubles Size Of Crypto Enforcement Unit

If anyone doubted Chairman Gensler’s commitment to a greater regulatory focus on crypto, this move should put those doubts to rest.

What Should Private Funds Do About New SEC Disclosure Rules?

The SEC is making a move into the private fund investment space.

The Implications Of The UAE’s Shortened Workweek On Compliance

It may be just a four-hour difference, but all it takes is one misstep for a firm to find itself dealing with the kinds…

Illegal Insider Trading: Not Just A Concern For Financial Firms

Whether it’s through proposed amendments to existing rules or novel ways in which to approach such activity, the SEC continues to be laser focused…

Illegal Insider Gifting Poses New Compliance Risk For Firms

What is illegal insider gifting and why is it suddenly a potential problem for financial firms? In this week’s StarBlog, our resident insider-trading expert…

What Does Working From Home Mean for Workplace Romance?

With Valentine’s Day this week, love was in the air.

Shadow Trading: How to Monitor For This New Compliance Risk

What is shadow trading, and what can compliance teams do about it? Star’s Head of Business Development and veteran compliance officer Steve Brown recommends…

What Proposed Changes To Rule 10b5-1 Mean For Compliance Teams

SEC Rule 10b5-1, which governs stock trading plans by company insiders, could be getting an overhaul.

Are Your Employees Illegally Trading Company Stock?

Whether it’s through proposed amendments to existing rules or novel ways in which to approach such activity, the SEC continues to be laser focused…

How Firms Should Manage Compliance Priorities In The Gensler Era

New SEC Chairman Gary Gensler will certainly bring new SEC regulations in tow along with him.

Clear Policy Management Is Your Compliance Program’s Best Defense

In this blog post, we discuss the importance of clear, accessible policies in conducting a thorough investigation.

The Growth of State-Specific Data Protection Laws in the U.S.

Several years ago, the EU collectively introduced GDPR (General Data Privacy Requirements), which went into effect on May 25, 2018, and covers all 27…

FCA Update: Remote-Hybrid Work Expectations For Firms

Whether your firm is already registered or applying to be registered, the FCA has some very specific, and not so specific, expectations as regards…

Meet The Latest Compliance Expert To Join StarCompliance: Steve Brown

Steve Brown, Star’s new Managing Director and Head of Business Development, arrives with a wealth of industry knowledge born of more than 25 years…

Curbing Outside Business Activity Risk In The Age Of The Finfluencer

MassMutual has been fined $4 million for the outside business activity, a.k.a., social media influencing, of one its employees—Keith Gill of r/wallstreetbets fame.

Four Changes At Four Major Regulators

Regulators in Germany, Canada, and the US are going through various high-level organizational and personnel changes.

Adopting A Hybrid Work Model? Keep 3 Things In Mind To Protect MNPI

Control room officers must keep MNPI in all the right places, no matter where monitored employees are working from.

5 Control Room Strategies For The Coming World Of Hybrid Work

Stay flexible with your people. Risk-rank your projects. Document your processes.

Top Takeaways From The Star Crypto & Compliance Webinar

Define your business model. Have something to show regulators. Remember the Howey Test.

How To Keep Track Of Outside Business Activity

Compliance-process automation software like the STAR Platform can help your firm monitor and manage outside business activity with simplicity and ease.

Protecting Your Chief Compliance Officer From Undue Liability

CCOs are increasingly worried their responsibilities could find them facing career-ending securities charges.

Crypto & Compliance: Key Findings From The StarCompliance Market Study

Star surveyed the marketplace to find out how firms are treating cryptocurrencies and digital assets with regard to employee trading, as well as their…

5 Ways The Biden Administration Will Affect Financial Compliance

A renewed focus on the main-street investor. A heightened focus on financial fraud. More focus than ever on all things ESG.

How to Prepare for Brexit’s Impact on Financial Services

Despite uncertainty over how Brexit may alter banking compliance regulations, compliance leaders can take a few steps now to ensure firm adaptability later

Regulation Update: Leadership Changes In Motion at the FCA and BaFin

Last month we covered the upcoming change in leadership at the SEC.

Regulation: What To Expect From The New Head Of The SEC

President Biden has tapped Gary Gensler to be the new head of the SEC.

Brexit: What The FCA Wants You To Know

With the transition period over, and a trade deal done that doesn’t cover financial services, the City of London and its resident firms are…

FCA Market Abuse Update: Takeaways From A Recent Industry Talk

We cover a speech by the FCA’s Director Of Market Oversight on insider trading challenges as relates to COVID-19, and tell you how Star…

The OCC Authorizes Cryptocurrency Custody Services

A shift in how the world sees cryptocurrency is influencing how the US government sees it.

New E-Book: The Control Room Handbook

Get happy! Our brand new e-guide on all things control room is about to drop! Learn what’s inside, how it could change the way…

5 More Takeaways From Our Deep-Dive Webinar On Control Room Fundamentals

Why building a control room is like flying an airplane, and other insights from a recent Star webinar with control room veteran, Steve Brown

5 Takeaways From Our Deep-Dive Webinar On Control Room Fundamentals

Why control room is like a bike race and other insights from a recent Star webinar with control room veteran, compliance consultant, and co-author…

E-Book Sneak Preview: The Compliance Control Room Handbook

Our new e-book on all things control room will be available soon, so be sure to keep an eye on this space.

Making The Translation: Turning A Code Of Ethics Into Code

COVID-19 isn’t slowing down compliance departments from making the changes they need to make, like implementing new software.

Three Signs You May Not Be Running A Tight Compliance Ship

Is your compliance ship starting to take on water in these stormy seas of pandemic-induced market and economic turmoil? How would you even know…

5 Surprising Findings From Our Covid-19 Compliance Survey

The world has changed and compliance along with it.

Why WFH Is Making The FCA Nervous And What Firms Can Do About It

In Market Watch 63, the regulator’s latest newsletter, the FCA outlines its concerns surrounding remote work and the increased potential for market abuse.

COVID-19 Compliance Update: The FCA Loosens Up The Regulatory Reins

Market volatility means greater regulator flexibility, at least to some degree, as the UK regulator adjusts to the strange new world of the coronavirus…

Making Things Simple: How Three Compliance Leaders Are Tackling Complexity

This blog is adapted from the Star US Conference panel discussion «Change, Challenges, Solutions & Scale,» which offered a look at the challenges three…

Making The Modern Control Room: A Conversation

Adapted from the Star US Conference panel discussion, «Making The Modern Control Room,» which offered the facts, forecasts, and considered opinions of two control…

Control Room Software: Why One Big Firm Suddenly Sees It As Essential

Automation has come to the deal-conflicts software space, as it has already come to the employee conflicts software space.

Complete Data Coverage: How Regtech Changed The Job Of One UK Compliance Officer

Changing expectations, getting to a clean bill of health, and predicting the future

Tech Takes Charge: Five Insights Into The Future Of Banking

Drawn from a recent Sunday Times special pullout section on where banking is now and where it’s headed

Step Away From The Spreadsheets: Optimizing Your Control Room

Five critical insights and takeaways from a recent «Sunday Times» special report on the future of banking, featuring StarCompliance

Ephemeral Messaging Apps: Back In The Hands Of Compliance Officers

The DOJ has softened its stance on the Snapchats of the app world, and in the process may have made things harder for compliance

Compliance Control Room: View From The Corner Office

Star CEO Jennifer Sun gives her top-of-the-team perspective on this new software solution and why firms of all sizes can benefit from it

4 Ways To Know You Need To Automate Your Control Room

If you’re still not convinced of the benefits of automation, or are dealing with doubters elsewhere in the organization, this blog can help

4 Anzeichen dafür, dass Sie Ihren Kontrollraum automatisieren müssen

Wenn Sie immer noch nicht von den Vorteilen der Automatisierung überzeugt sind oder mit Zweiflern in Ihrem Unternehmen zu tun haben, kann dieser Blog…

4 Anzeichen dafür, dass Sie Ihren Kontrollraum automatisieren müssen

Wenn Sie immer noch nicht von den Vorteilen der Automatisierung überzeugt sind oder mit Zweiflern in Ihrem Unternehmen zu tun haben, kann dieser Blog…

4 Anzeichen dafür, dass Sie Ihren Kontrollraum automatisieren müssen

Wenn Sie immer noch nicht von den Vorteilen der Automatisierung überzeugt sind oder mit Zweiflern in Ihrem Unternehmen zu tun haben, kann dieser Blog…

4 façons de savoir que vous avez besoin d’automatiser votre salle de contrôle

Si vous n’êtes toujours pas convaincu des avantages de l’automatisation, ou si vous avez affaire à des sceptiques au sein de votre organisation, ce…

4 façons de savoir que vous devez automatiser votre salle de contrôle

Si vous n’êtes toujours pas convaincu des avantages de l’automatisation ou si vous avez affaire à des sceptiques ailleurs dans l’organisation, ce blog peut…

4 Ways To Know You Need To Automate Your Control Room

If you’re still not convinced of the benefits of automation, or are dealing with doubters elsewhere in the organization, this blog can help

5 Features Any Good Compliance Control Room Product Will Have

Control rooms aren’t just for big banks anymore.

5 Funktionen, die jedes gute Compliance-Kontrollraumprodukt haben sollte

Kontrollräume sind nicht mehr nur großen Banken vorbehalten.

5 Funktionen, die jedes gute Compliance-Kontrollraumprodukt haben sollte

Kontrollräume sind nicht mehr nur großen Banken vorbehalten.

5 Funktionen, die jedes gute Compliance-Kontrollraumprodukt haben sollte

Kontrollräume sind nicht mehr nur großen Banken vorbehalten.

5 caractéristiques Tout bon produit de salle de contrôle de la conformité aura

Les salles de contrôle ne sont plus seulement pour les grandes banques.

5 caractéristiques que tout produit de salle de contrôle de bonne conformité aura

Les salles de contrôle ne sont plus réservées aux grandes banques.

5 Features Any Good Compliance Control Room Product Will Have

Control rooms aren’t just for big banks anymore.

Compliance Control Room: What Is It And Who Needs It?

One of Africa’s biggest banks need it, and soon enough so may you.

FCA Sector Views: The State Of Wholesale Financial Markets

This critical sector is healthy as a Brexit-free horse, at least for the moment

FCA Sector Views: The State Of Investment Management

The sector is experiencing substantial growth, but challenges loom

Increasing The Efficiency Of Your Compliance Program

Proposed solutions to many of the pain points the modern compliance officer faces

Considering The Human Factor In Your Compliance Program: Part Two

Insights from psychodynamic-management consultant Dr.

Considering The Human Factor In Your Compliance Program: Part One

Insights from psychodynamic management consultant Dr.

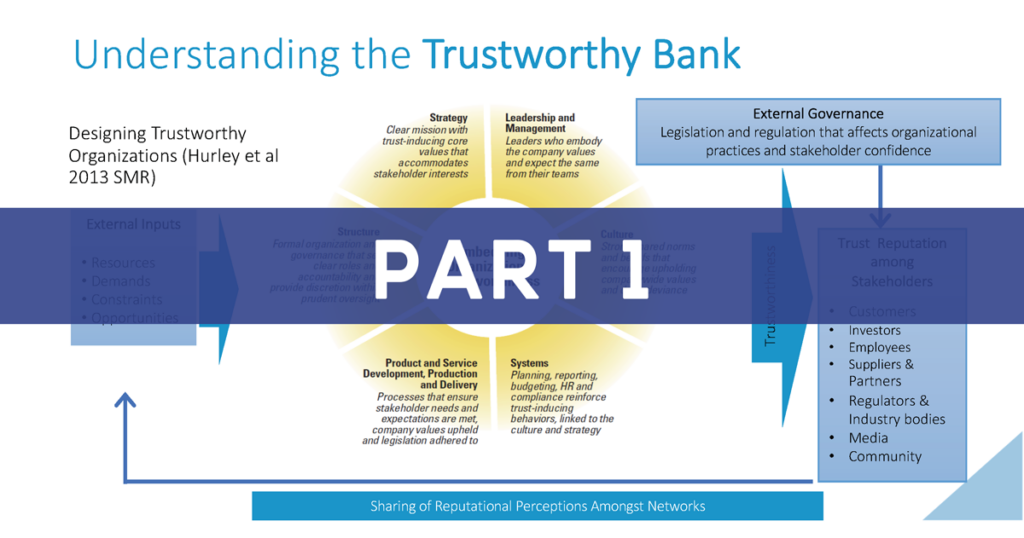

The Paradox Of Trust And Control: Why Understanding It Is Key To Organizational Risk Management

The first of two blogs covering organizational psychologist Dr.

The Compliance Officer’s Ultimate Compliance Guide

How to build a compliance program that will keep you up to date, up to speed, and in the know

Dodgy Investments And Drift Prevention

Five more key takeaways from the Star US User Conference

Under Review: Deferred Prosecution Agreements In The UK

DPAs remain popular enforcement mechanisms around the world, but questions linger

New Deadline For New York Data-Security Law

September 1 is the next important date to keep in mind for 23 NYCRR §500

The History Of Financial Fraud In 25 Recurring Behaviors

When it comes to market misconduct, the more things change the more they stay the same

Whistleblowers And The Countries Working Hard to Embrace Them

Governments are figuring out that whistleblowers deserve protection

Robo-Advisers Are Here To Stay

Your Gen-X and Millennial employees love them.

Italy: Stepping Up To Give Corruption The Boot

New anti-corruption measures will help keep everyone on their toes

The Long Awaited Return Of South Africa

There’s real hope the continent’s shining star is regaining its shimmer

Sapin 2: France Means Business

The country’s second sweeping attempt to address corruption and how to stay on top of it

Trade Surveillance: MiFID 2 Revisited

The latest MiFID makes trade surveillance a priority.

MiFID 2: Tricky Name, Tricky Job

The new Markets in Financial Instruments Directive will be as hard to implement as it is to pronounce